Average Student Loan Debt For Medical Doctors

Some creditors, like PG&E will work with you to set up a payment schedule, then you can make sure to work this into your monthly budget. Best Debt Consolidation Agency You could reduce the monthly total payment. It could be the car breaking down unexpectedly or an illness the requires expensive medicines. Read more on this site MorePay3 Just by applying your own mind, you can select the best lender for you with the best offer. Offer a thorough search before taking any decision on education loan consolidation rates. We never touch your monthly payments, you only have access to those funds.

How Long Do You Repay Student Loans

First loan installment will start one year after completion of education for which the loan was obtained or one year after getting first job, whichever comes earlier. It is important to contact your loan company when graduating because missed payments on federal student loans may lead to additional charges or default. If the student fails to continue to meet the conditions, the loan will go back in effect. As a result, the Occupy Colleges and Occupy Student Debt movements merged in 2018 in an effort to gain support from students around the country. the total amount you borrowed; and Most Financial advisors and realtors will advise you against joint ownership with a child.

Do not ever, let the admissions office know you view this school as a last resort. Some argue that this convenience is offset by the likelihood of student over-borrowing and/or usage of funds for inappropriate purposes, since there is no third-party documentation the amount of the loan is appropriate for the education needs of the student in question, or that it will be used only for education. A�Career�Development Loan�is a bank loan, �although the�interest is slightly less. There are innumerable expenses that contain to be met punctually or otherwise create a pile that becomes more difficult to manage. No Claim of Ownership is created by SITS, for any data presented on this page or elsewhere.

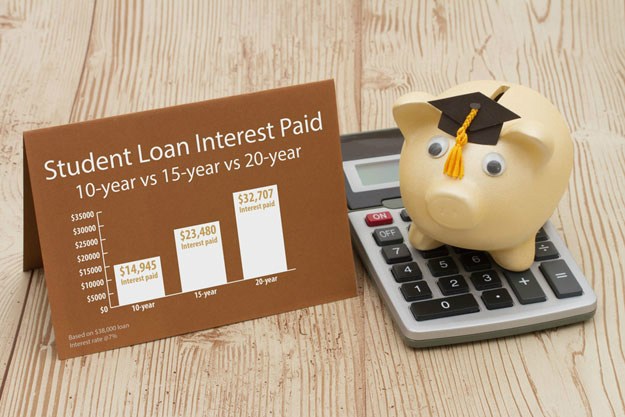

These individuals didn't know you will f. Because of the rate of interest this implies that you will be paying more money since the number of payments is increased, which naturally increases the amount of interest paid. DMCC also provides free assistance to any consumer needing a solution to their debt problems, including personal budgeting, debt repayment plans, credit restoration, student loan consolidation and mortgages. One more thing, if you do not have the money to pay the debt off in full then pay something. Taking out a consolidation loan is a way to aid you of your credit problems, never to get into more. You can apply for international student education loans, but you may need your loan to be signed by a co-signer who is a citizen of the United States or maybe a resident of the country. The consolidator then restructures the loan, resulting in lower repayment amounts, but usually a longer payment term.

In a student, the financial institution sees a new client having a promising future! College Loans Problems To get a college or university degrees currently require substantial funding. This signifies that repayment will get started only when trainees commences to work and earn. This will likely involve the judge taking a look at your financial situation and aiming a repayment schedule so that you can pay back what you owe at a rate you are able to afford. Student loan consolidation could be a highly effective solution to avoid default and the hassles that affect your credit and financial future for many years. When a bank is offering a student loan, they will want documentation of your income and likely expenses.

last next

Popular Articles

Employers That Pay Off Student Loans

Repaying Private Student Loan Options

Consolidating Private Student Loans

Student Financial Aid Services

Citibank Student Loans Consolidation

Private Student Loans Pnc Bank

Chase Student Loans For College

Refinance Student Loans Good Or Bad

How The Government Can Help You Pay Off Your Student Loans

Loans For College No Credit