Average Student Loan Debt Private School

The interest price for unsubsidized federal undergraduate loans is low, fixed at only 6. Some banks demand all in the subsequent documents as pre sanction documents: In fact , they'd have been much better off to save the money towards a mortgage deposit for him, as that's a far more struggle. The rate interesting is lower than your loan consolidations and so you pay lower monthly payments.

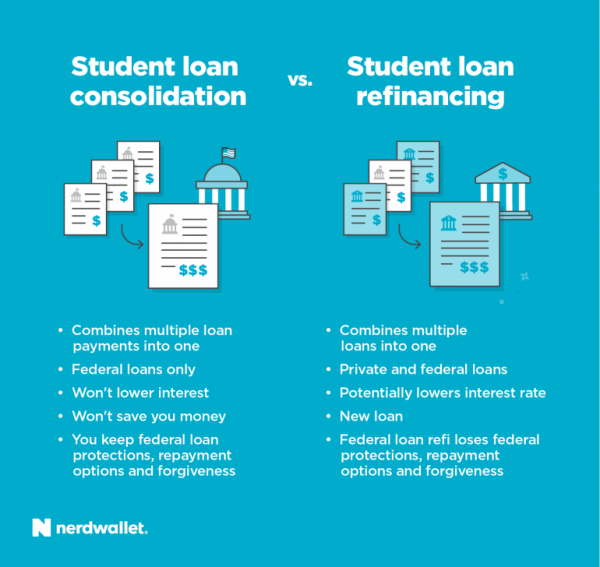

Simply make your payments on time every month. Direct Loans For Student Loan Consolidation One has to consider students Loan Forgiveness Act that President Obama put into effect fairly recently. They also provide you with the ability to use search function for particular keywords regarding subject areas of interest. But in order to understand whether or not refinancing is a good option, you first need to understand the basics of how refinancing interest rates work. ?Venturing into Debt Collection Agency Organization Through getting a debt consolidation loan you will be able to bring you accounts and loans current.

However this step must be seen as a last resort as a commercial collection agency agency typically charges 10/15% percent of the debt as their fee. Article: This article features our discussion in the class the p. Students desperate to apply for financial aid are required to develop a FAFSA. Many people get caught in the process of buying the home, and so they think they are going to are in it forever, and they forget to consider this very important item. These loans are approved against your next month paycheck. If you are eligible and you sign up for, and are approved for a $0.

You may choose (depending on the lender) have deferred payments until after completion of, or rates of interest only during the time you are signed up for an educational institution to do. In this kind of loan the government does not pays any interest at any time in fact it is the sole responsibility of the student to pay the interest as well as the principal amount, though the student can defer the interest rate for a further agreed period of time. Over the past months students have been able to find the funding from grants and scholarships they need to meet university tuition, fees, and textbook costs by simply researching online, talking with the financial assistance office at their university or university, or by filling out a FAFSA form for free federal financial aid. To get enrolled and avail all such credit card debt consolidation services you can take the help of internet. The repayment period depends primarily on exactly how much you should be spending every month.

There are some simple measures which will help you keep your CIBIL Score on right side of the graph: Refinancing Student Loans Legislation Shaw's loans were made under a now-defunct program called Federal Family Education Loan, or FFEL, in which the government guaranteed loans made by private lenders. Before taking their student debt consolidation program, do not forget to check on other offers in the market. There are many ways to pay for university education. Things seem to be un-reversibly on the downside, but then you find this article on credit card debt consolidation counseling and breathe hope again. The Consumer Financial Protection Bureau, a consumer financial watchdog agency, is fighting Navient in court over allegations the company deceived borrowers about repayment options and the rights.

<<< next article

When Start Repaying Student Loan

Help With Repaying Defaulted Student Loans

Pay Student Loans Off Or Save

Reduce Student Loan Payments Monthly

Lower Student Loan Interest Rate Trump

Student Loan Repayment Tax Deduction

Federal Student Loan Repayment Plans

Private College Loan Debt Consolidation

Repaying Private Student Loan Options

Refinancing Student Loans Lower Interest Rate