Best Home Loan Rate

In those conditions no matter no matter if you have a higher college diploma or an equivalent certificate, such as a GED. Debt consolidation loans are a solution to such critical situation. If the person is not committed enough, the recovery process could be a disaster. is part of the MoneySupermarket Group, but is entirely editorially independent. Loans which may need to be considered for consolidation include student loans, credit card balance transfers, home loans and personal. Best Home Loan Rate Paying for College Without Going Broke

If you have a score that is not so good, or you still do not have started a credit history, you may need a co-signer in order to apply for your loan. Can You Refinance A Student Loan After Consolidation If the borrower chooses secured loans then the borrower will have to place some assets like car, home and jewellery as the collateral against the loan amount. They can be legally allowed to lend 35 times as much money because they have, and they make no profit until they lend it. Sit down and take some time out list out your entire expenses. Rebounding from debt also means you may have to make certain that the problems that led you to debt should be avoided.

Let us not let the king of terror come and reign in�our hearts. The most used choice is the standard repayment. This advanced planning can save you thousands of dollars in student loans and even help you graduate earlier. Most of the debt consolidation companies you will find around you are non-profit organizations. ?Credit Card Debt Consolidation: How To Get Out Of Your Credit Card Debt In An Easiest method Solving Student Finance Issues I started paying interest 6 days after my first maintenance loan payment.

We're here to give you the ultimate guide to understanding the debt you're in so you can stop stressing about it and begin taking steps to get yourself out of it. This type of loan enables you to benefit from the security of a Key Bank as your recognized loan provider. * Can you choose between fixed and variable interest? The main word to you, a recent college or university graduate, should be b-u-d-g-e-t. As you are reading this likely online, then I will concentrate on online methods, as the internet is an excellent spot to start a project which could pay your student tuition fees, your student loan, and hopefully provide you a long-term nest egg. Global Student Loan Corporation - We help put the world through school.

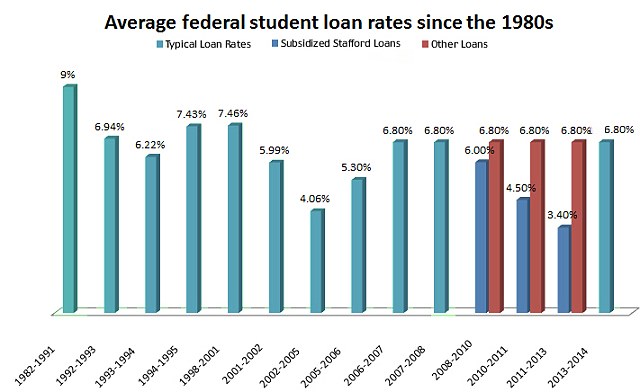

The loan consolidation method is not meant only for students with high paying jobs. Stafford Loans are guaranteed by the government of the United States. Now he has arthritis and if I changed insurer he would not be covered for that or anything relating to problems with his back legs. Best Home Loan Rate The large number of combined courses enable students to develop skills in a diverse range of areas. These top-notch students, though, are small minority.

A principal deduction of $300 is made on every private student loan when the student graduates. Can Private Student Loans Be Consolidated With Federal Banks are incredibly happy to give loans to students whose parents or other loved ones are in good credit history with them, and prepared to stand surety for the money. It is possible to run into financial conditions where debt may become necessary. 56% for their 5-year variable rate product and start at�3. However , before you decide to do balance transfer, you need to watch out for potential hidden costs and other fees.

<<< >>>

Related Articles

Total College Debt

Paying Back Student Loans Wales

Private Student Loans Reg Z

Parent Student Loan Interest Rates

Pay Student Loans Off Fast

Benefits Of Consolidating Your Student Loans

Student Debt Moving Abroad

Private Student Loan Consolidation Options

Quebec Student Loan Repayment Calculator

Defaulting On Student Loans Hurt Credit