Bill To Reduce Student Loan Interest

A college degree generally gives people a leg up in buying a home and achieving other middle-class goals. I also hope it provides you with a few tips and some good Student Loans With Bad Credit advice to think about when getting your Student Loan. Auto-pay is easy to setup and convenient for borrowers. Making counter-claims makes it more likely that the lender will drop the case or tend to settle out of court, if they think it could be an extended and costly legal process. Most of the students hope to get high salaries at the end of their professional training also to be in a position to pay back the loans within a period of time. Bill To Reduce Student Loan Interest Page modified: Mon 8 May 2018 02: 42: 08

But now, you don't need to worry about your shocking account balance because, there is certainly one more lending company which also provides you the loan however, not even check your credit balance like others and the name of this lending company is doorstep no credit check loans. Us National Student Debt After twelve months of paying on time you are who is fit! The government will report the previously defaulted loan towards the credit bureaus. If you are suffering from multiple debts caused by your student loans and you have a hardship to repay them on schedule each month, then a student loan consolidation may be a good option for you to rescue you from this financial burden. Wow, $26, 000 on average of student debt! That is pretty shocking! I graduated from Berea College in Kentucky with a work-study program and I had nearly no student debt. Register now to choose your voice heard.

At the very least, IBM could have beat Microsoft to the punch. It truly is highly recommended to first go and try your luck in federal student aid. A high level00 returning student, you will get the money when you have registered for the season. Nevertheless, you decide to submit your education loan application, there are a number of free resources available to ensure you submit the proper information and receive the correct quantity of financial assistance. But you may be wondering what about the specific usage of the word write off debt in order to applies particularly to that huge pile of money that you owe? What happens when credit card companies write off debt is that they are accountable to the government any money that they have not managed to acquire from creditors. � Simple, fast and straightforward service If you have a bad credit history, you very likely will pay a higher interest rate, but don't be discouraged.

You need to identify what went wrong so that any plan that you make to bounce back from your financial crisis can cope with the root of the problem. not susceptible to student loan consolidation providers. Teachers must work in discovered low income or high-risk schools to qualify for the program and can have up to $17, 500 forgiven at the end of the five years. com to get specific Student Loans Consolidation information. ?Max International Business Scam - Are We All Being Taken? The interest levels on loans are climbing steeply and students still at school and even graduates are finding it near impossible to look for a job that can support them well enough that they can pay off their loans as well as the rest of their living expenses. Some students are awarded a Stafford Loan.

Student Loan Consolidation Companies

If you decide to use a 529 school savings account, you will need to declare it on your FAFSA application. Thus, we see that the student auto loan has made it much plus more easy on the part of the students to avail a car for themselves. In this case, you should think about student debt consolidation loan. Bill To Reduce Student Loan Interest Your multiple loans will be changed into one loan with only one payment to make every month. A short-term goal might be a new car, a vacation or possibly a television. ?A Private Company not affiliated with the Department of Education or Federal Government

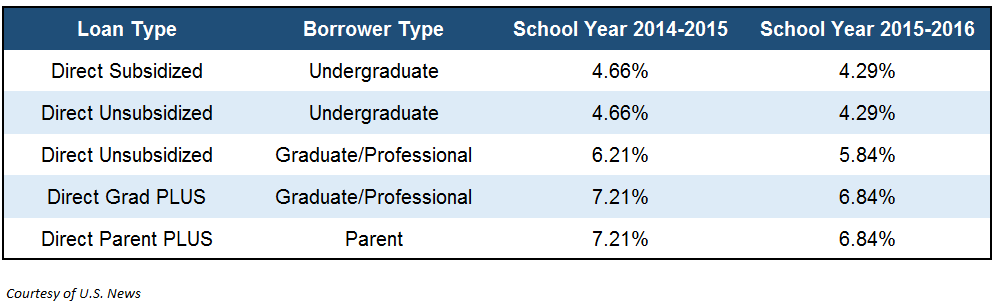

Poor credit remortgage have interest rate alternative �fixed, variable, capped, discounted, flexible, tracker. Bill To Reduce Student Loan Interest Interest is defined as 'A fee charged by a lender to a borrower, for the use of borrowed money, usually expressed as an annual percentage of the principal amount. So how does an unsubsidized loan vary from a subsidized one? Technically, the subsidized student loan and unsubsidized student loan do not differ much in nature. Jim, Those are great suggestions. Federal Perkins loans are merely for many who are facing acute financial crises. Repaying your education loan more quickly Almost 124 million Americans own their own home.

Student Loan lenders are attempting to lessen the blow of this deficit. Fifth Third Bank Auto Loan Payments Don't acknowledge that the debt is yours. Message from: If you can, please donate to the full-text RSS service so we can continue developing it. This threshold will be the same as the threshold below which the rate of interest is the rate of inflation: �21, 000 in the first year (see above). The program was started by the Department of education and having its help any student are now able to study properly without having to stress about his financial situation. However , private contractors - such as Navient, the former Sallie Mae division - continue to acquire costs to administer the federally backed loans.

last >>>

Related Topics

Education Loan Payments Tax Deductible

How To Get A Student Loan Consolidation

Getting Out Of Default Student Loan

School Loan Lawyers

What Are The Effects Of Consolidating Your Student Loans Is

How Do You Consolidate All Of Your Student Loans

Private College Loan Consolidation Jobs

National Student Loan Relief Center

Consolidating Public And Private Student Loans

Can You Consolidate A Private Student Loan Into A Federal Loan