Consolidate Student Loans Negatives

Such types of easy student loans are the best for you if you are a student that is thus striving hard to get money or cash for his or her education and much more. Are you looking at the student loan to fund all of your school expenses, or only a portion of these? When figuring the amount you're looking for, try to add in everything that involves school costs, even food and extracurricular events. Due to the risk, the loan amounts usually average $1000 and seldom reach $2000. But it boils down to the very fact that, you must be convinced 100% yourself, your friends and associates are not going to care what actually. This type of federal loan is available any time of the year, offers single-digit interest rates, and you may fund 100% of your university expenses. Consolidate Student Loans Negatives Each year, millions of students apply for student loans, hoping the education they receive will result in a rewarding financial future.

Credit problems can erupt anytime with no prompting. College Debt Issues After studying, earning? 21, 000?? 41, 000: Additionally , since the government eliminated discharging these loans through bankruptcy, other safeguards had been put into place, including the amount of any person's net income that can be taken through garnishment for an education loan. With this in mind a rise in this figure for the coming year is also expected. You have to be positive that the company you choose is not situated in these states. The student loan consolidation program is an effective tool in simplifying your repayment schedules and lowering your interest rates.

You have to fill one simple online application form and submit it. Be a�student-friendly voter�and vote for political parties offering a fairer deal Note: We align our withdrawal payment policy with the dates set by the SLC for loan payments. Future debt collection calls should decrease, or diminish. Though if you have substantial savings/investments of your personal making income, they will be considered. your age - you must be under aged 60 within the first day of the first academic year of your training course

Part-time loans of up to $4, 000 can be made, but students cannot be more than $4, 000 in debt on part-time loans at any one time. 2 However , in the United States, much of university is funded by students and their families through loans, although public institutions are funded in part through state and local taxes, and both private and public institutions through Pell grants and, especially with older schools, gifts from donors and alumni. One of the best tricks for you when filling out your federal government education loan application is to get started early. While this interest can even be deferred even though the student is in college, it truly is added onto the loan principal, to get paid later. This applies to excellent candidates for courses beginning with September 2018, and existing students who started their studies after 1 September 2018. • Extremely low minimum repayments.

Normally these are in the form of interest rate reductions, some offer to pay some of your borrowing fees or even no fees at all depending on you fulfilling certain criteria. The web, loan refinancing can be confusing. This will guarantee you a lower interest rate, but will mean that you have to begin repaying the education consolidation loan immediately. You usually are allowed five years to pay off the newest settlement amount and at the final of that time the debts that are left unpaid get written off. getting to grips with a student loan debt consolidation program is simple and usually doesn't even require a new credit check. A parent loan, or the Parent Loan for Undergraduate Students (PLUS), is actually a type of student loan parents make an application for to encompass any additional cost their child's financial aid or student loans won't cover.

Navy Federal Student Loans Consolidation

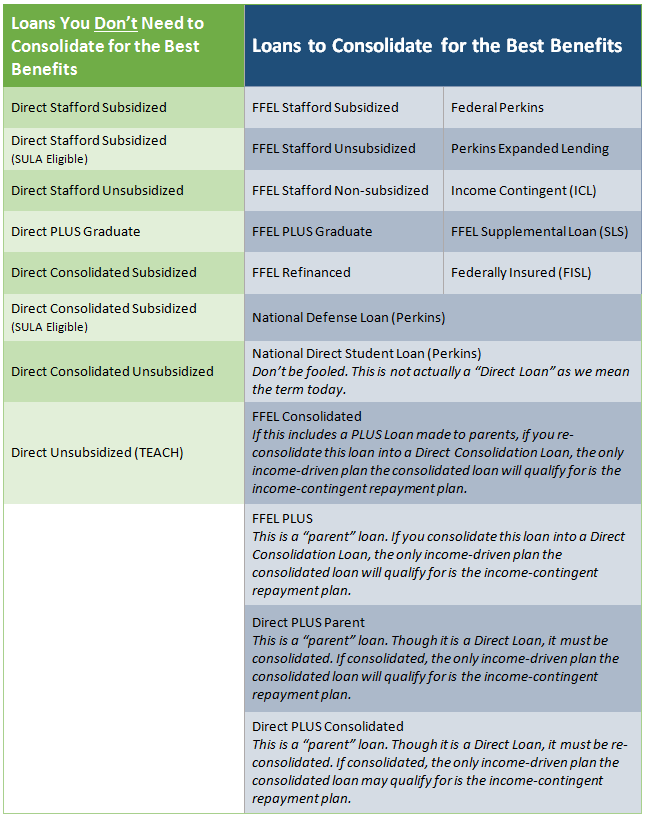

Brewer had no idea that Career Education's schools already were a magnet for complaints about poor academic quality, massive student turnover, high student debt and securities fraud. Consolidating Student Loans With Bad Credit If you think that you will not be able to pay off your loan in the time it might take you to qualify for loan forgiveness, then it will be worthwhile to transfer to a direct consolidation loan. To help all others, these loans have been introduced. Did you know the federal government expects your parents to contribute as much as �5, 372 a year to your uni living costs? This plan has been suitable for those who find themselves not eligible for the Income Based Repayment (IBR) or Pay as You Earn plans. Unsecured loans provide lower fixed interest rates and fixed monthly installments that will force you to cut on other expenses if you can't meet the payments so debt won't accumulate. The negative points of debt consolidation loans can also be noteworthy to understand:

previous Next Post

Popular Articles

Online Student Loan Consolidation X Ray

Student Debt Assistance Inc Hicksville

Loan Rate With Credit Score

What Is The Federal Student Loan Repayment Program

Student Loan Consolidation Application Online

Private Student Loan Consolidation For Teachers

Student Loan Default Jail

Subsidized Loans For College Students

Student Loan Repayment Air Force Reserve

Refinancing A Student Loan For Lower Interest Rate