Defaulted Student Loan Go Back To School

Further complicating matters, the undue hardship standard varies from jurisdiction to jurisdiction, but is generally difficult to meet, making student loans practically non-dischargeable through bankruptcy. Maximum monthly payment is 10% of discretionary income - the difference between adjusted gross income and 150% of poverty guidelines - and a maximum term of 20 years to have the loan(s) paid in full; Do you require funds to pay for your degree or non-degree courses?

If you currently have high interest rates or a variable rate loan, you may want to consider refinancing your�student loans. Ways To Get Rid Of School Loan Debt Also, student loan debt does not be eligible for dismissal in bankruptcy proceedings - so this is a debt that will haunt you pay or you become disabled or die. Stafford Student education loans are the primary source of federal aid for qualifying students. At LendEDU we use only the top companies who refinance student loans and consolidate student loans. Debt consolidation is a good idea when you are paying your own card debt. It is better to stick with a well-established financial institution or non-profit lender with a solid reputation even if the rates are a bit higher. When he or she is faced with the reality of the real world, he or she is inundated with not only weekly and monthly bills, but also paying back student loans.

Simplify your federal government student loan application by having all the necessary information with you at the time you fill it out. Lower Interest: You lessen the amount of interest you are paying. All of it meant more money for the money industry. It is highly recommended that you utilizes Sallie Mae loans rather than private loans from banks. Doctors who practice medicine in rural or low-income areas are another example of this loan discharge. Full information on the loans, including maximum amounts and means-tested elements, are yet to be announced, we'll update this guide once we know more.

The time scale of application has been changed, to ensure that a student can apply for finance at the same time because they apply for an university place and information is being shared in such a way that repeated requests for the similar student details will be eliminated. This is a serious step that ought to be considered carefully along with better money management skills and budgeting disciplines. Anda dapat juga membuatnya tampak bergaya kasual, dengan gaun putih serta sepatu bot putih tidak tipis. Many students actually experience sticker shock because they did not recognize that a lot student loan debt had accumulated over the course of four to 10 years in college. If you are somebody who needs a lot of motivation to repay your financial troubles, then the snowball approach is right for you. Using collateral will attract low rate of interest. Private student loans are administered by standard lending institutions.

It could take years to pay off credit card debt. The Trump approach would represent one more radical change for the educational funding system that former President Barack Obama overhauled. The most familiar type of federal loan for students is Stafford loans. This decision would not greatly change the socio-economic backgrounds of students attending universities because only 20 to 25 % of students paid service fees as most had Commonwealth scholarships. Even if your loan is serviced by a private company, it might still be a federal loan. This system of collection is recognized as Income Contingent Repayment.

Seeking them out may be difficult, but not practically as bad as the results of not doing so! Uic Office Of Student Financial Aid The same technique has been programmed into the software so that you can use the forex robot to repeatedly take out profits from each forex trade, each time a reasonable amount of profits. If you do not respond or do not attend court, the claim will automatically be awarded against you. If the wages are being garnished as a result of delinquent student loans, yet , a bankruptcy might not exactly fix your garnishment issue; in most cases student loans-either private or government-backed-cannot be discharged in a bankruptcy. This is referred to as vicious circle of debt. If you are able to obtain a fixed line of credit for your company, this is normally better than higher interest corporate credit cards. You can apply for a loan if you are going after your college degree, and you can apply for loans if you are attending graduate school, law school or any other type of professional training.

<<< Next Post

You Might Like

Debt Relief For Corinthian Students

Student Debt Crisis Stories

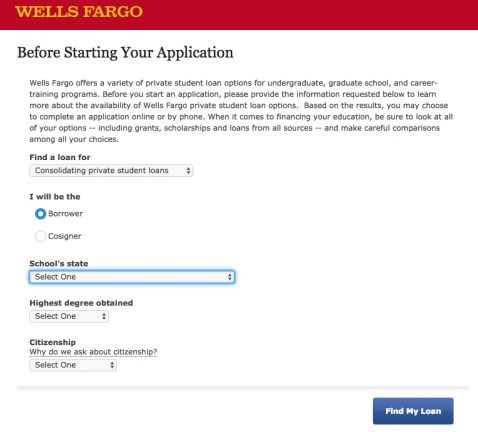

Private Student Loan Wells Fargo

Arkansas Association Of Student Financial Aid Administrators

Consolidate Student Loans Gov Jobs

Student Loans Pay With Credit Card

Consolidating Student Loans Into Mortgage

What Is Consolidating A Student Loan

Student Loans Debt Calculator

Can You Deduct College Loan Interest