Fixed Interest Rate Student Loan Consolidation

We are an affiliate of Pingtrees in the UK who have use of a database of loan partners. Mathys Law Group has been in business over 10 years doing ONLY credit card debt settlement (and the occasional bankruptcy). The correct resolution with this error is not a refund of $100 (or adjusting your balance by $100).

Example: a doctor treating someone with a particular disease needs to know what he's doing. Consolidating Student Loans Cons To help all others, these loans have been introduced. Any item inside your credit report is a serious matter. They can be legally allowed to lend 35 times as much money because they have, and they make no profit until they lend it. The Perkins Loan, Stafford Loan and the Federal Plus Loans are the three major types of federal loans today.

The latter is a 'lose-lose' situation for both the borrower and the cosigner that may compromise the integrity of their future credit. When looking at student borrowers who fall behind issues loan payments without defaulting, 27 percent of community school graduates experience this sort of delinquency, versus 39 percent of community school students who didn’ t complete their degree. ), Konsolidate and CommonBond were founded to offer student loans and refinance loans at lower rates than traditional repayment systems using an alumni-funded model. Since a Perkins Loan will not really gratify all of your student aid needs, you can apply for other federal student loan products, such as a Subsidized Stafford Loan or an Unsubsidized Stafford Loan. For future loans, a good credit score is vital to getting a much better rate of interest. Student Loan Consolidation Program is known as a loan repayment program for school students and graduates with multiple student loans for making their repayment easier.

You need a company that will provide you with an individualize payment plan. However , this may or might not work for everyone. Many students conclude their school life buried in debts provided by loan programs. In some cases, the antiretroviral medication appears to stop working after having a number of years, but in other cases persons can recover from AIDS and live with HIV to get a very long time. It's definitely going to become advantageous to look into. What do you do in case you are ineligible for student loan consolidation?

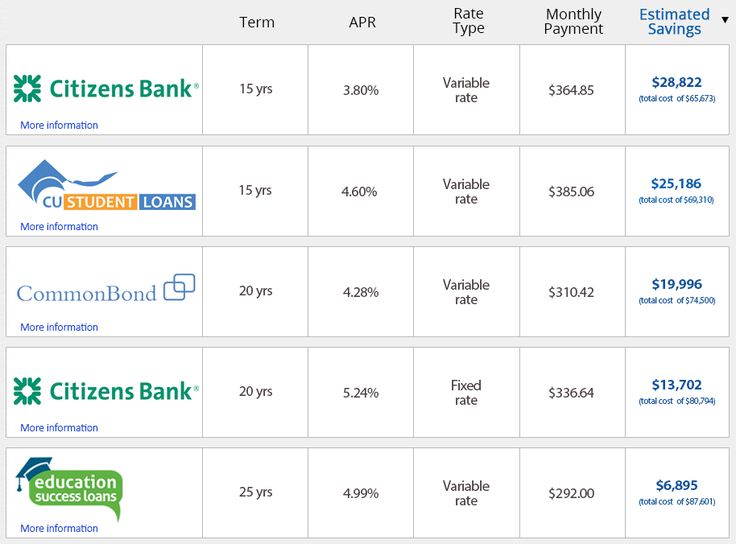

Student Loan Refinancing Fees

Borrowers with a bad credit score are available a credit card debt consolidation loan. Consolidate A Federal Student Loan The president of the Ny Federal Reserve. If you have Home or EU charge status, you can apply for a loan from your UK government to cover your tuition fees. Companies like or offer these programs. Even if your parents make $500, 000 a year, there is still a chance you are eligible for any free grant. Such fees may involve an upfront processing fee ( may cost up to 3% of the balance you transfer) and the interest rate after the offer period (the low or 0% rate will normally end in a few months), it may be higher than your current rate. Avoid Accumulating Debts: One you find yourself under debt you should take precautions so that you do not collect any further debts.

Previous Post Next Post

Help Repayment Threshold 14 15

Paying Off Student Loans In 1 Year

Private Student Loans Health Professions

Discharge Of Educational Loans

Private Student Loan Consolidation With Fixed Rate

College Debt Vs Credit Card Debt

College Debt In The Us

Emc School Loan

Student Loan Interest Rate Explained

Consolidate Student Loan Or Not