Help Paying Off A Student Loan

Note: Permission is granted to republish this article provided it is reproduced in its entirety with this resource block included. School Loans Debt The Vista Members are able to get money that they can use toward repayment from the lending options after they you are not selected regarding 1700 several hours. Good results . multiple loan and varied interest rated would make you nowhere. Many persons in all over the world take loans to gratify their needs. You can go to the Federal Student Assist Loan Consolidation internet site to discover out what applications will perform for you as nicely as how you can go about applying. There is also no charge on graduates who wish to repay their tuition cost loans early. You are n the dorm, and you can't afford to pay for all your books.

access-date= requires url= ( help ) The total amount of all the debts should be �5000. Scholarships and grants differ in this scholarship money is not so much need-based as it is merit-based, meaning they are awarded based on your own personal accomplishments or background. Fixed rates of interest on a consolidated loan cannot exceed 8. It would be the best possible loans approach that assists you well without allowing you to undergo a tiresome or time consuming loan processing. 1) Keep the non-tuition expenses low. The temptation to find an expensive place on your own after graduation can be incredibly strong.

Student Hub, student finance advisers: Completion rates are incorporated because one widely recognized metric of student success is the rate at which students are able to earn their degrees. Hi DDE, you are absolutely correct. So there are several options available for students to choose from. This section provides data on the amount of debt that students can expect to borrow at a given institution and against similar cohorts. So , the repayment schedule is simplified and the interest paid each month is lowered.

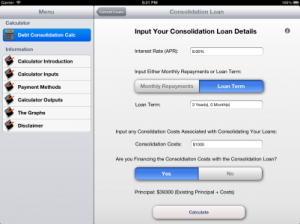

Finding banks or commercial lenders to handle your alternative student loans applications must not be difficult, as the student loan market is highly rewarding and growing rapidly. Together these form your 'Student Loan' although you will only ever get the maintenance loan into your banking account as the tuition charge loan is paid straight from the SLC to the University. PLease I need all the thoughts I can get right now. However , some lenders may enable you to refinance; compare different options above to look for a lender that may permit you to refinance. That�s why having a co-signer can be in your best interest (no pun intended! ). There can also be no costs or prepayment penalties as well as just one payment per month to a single lender. To be eligible for student loan consolidation, you must have a number of federal loans (Direct or FFEL) that are in repayment or in a grace period.

The loans are of different types and so you can be sure that your needs will be answered. College Loan Debt Reduction If a student is unemployed with insufficient savings of his or her own, then the cosigner is also required. In most cases, your student loans will be automatically disbursed to your college or university and will post to your account. I'm looking at this from the perspective of a mother of a soon-to-be university freshman, who's going to be saddled with loans. you must normally reside in England or Wales; and

prev. more articles

Chase Student Loans For College

College Loan Corp Consolidation

Federal School Loan Consolidation Help

Refinancing Student Loans Lower Interest Rate

Student Loan Interest Rate Rbc

National Student Loan Assistance Center

Is Student Loan Consolidation Worth It

Federal Student Loan Consolidation Spouse

College Loan Bad Credit

Bakersfield College Student Loans