Knightsbridge Debt Help

The total amount derived under these loans can be practically used to meet any expenses concerning business such as procuring raw materials, arranging transportation, paying wages and salary, clearing past debts and so on. Loan Consolidation Student Loans Advantages of Student Debt Consolidation A high level00 minor, you also need to present your parent's federal income tax return or Form 1040. You can also opt to receive a message notification when payments you made have been processed. With us you enjoy the ease of applying for a bad credit card debt consolidation loan UK online and the confidence of having secured the very best debt consolidation deal in UK from your wide network of reputed lenders. (Stillness in the Storm Editor) In honor of Ben's wishes to withhold posting the entire update here is a portion of his report.

The increase would mean a higher cost in interest charges before students had even graduated. Are you among the growing number of individuals who are bearing bad debt burden? Consider a debt solution to fight out your bad credits and debt. We will discuss possible “ remedies” - what you can get – from the FDCPA in future articles. If the requirements above sound good, we feel that you are a great applicant for student loan refinancing and consolidation. This person's original loan amount was $80, 000 that increased to a whopping $135, 000! How to I apply for a loan payment holiday?

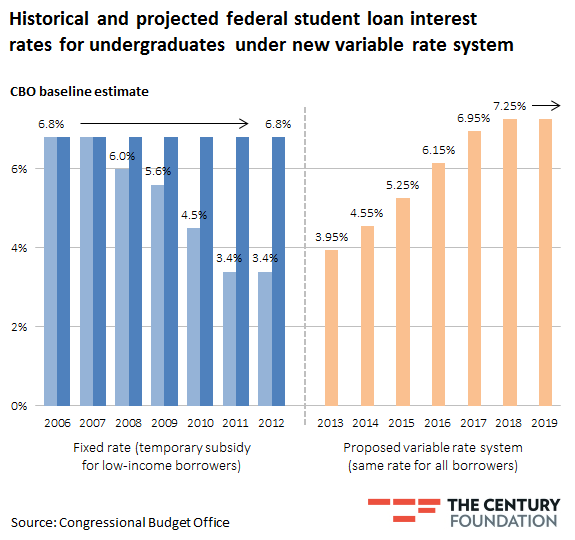

You can have the loan for tuition, room and board, off campus living expenses, books, supplies, lab fees, student activity fees, computer and printer, and other college needs even vacation expenses. Moreover, if you do earn enough to get started on paying back your loan, simply how much will you be paying? Say you earn �25, 000 12 months, your debt is probably increasing by �180 interest each month. Unfortunately, also in these economical times, almost all of us incorporate some financial worries or gaps in our credit history. Is debt mounting steadily as your monthly income falters and bills pile high? Are high interest rates on an unsecured loan burning a hole in your pocket? Do you find it hard to track your credit card payments with your other financial liabilities? Then perhaps it is time you considered secured debt consolidation loans in order to manage you financial liability over the long run. We discovered that many people who were also searching for information related to Student Loans Consolidation also searched online for related information such as Private Student Loans Comparison, Federal Consolidated Student Loan, and even Graduate Loans For Bad Credit. The causes are myriad, ranging from low family income, through high costs of education, to too expensive tastes individuals. A fixed interest rate versus variable interest is better because it locks in the amount you will in the end pay after consolidation.

Refinancing Student Loans While In School

Mary�2 years ago from Chicago area Examine the interest rate for the new , loan consolidation and only include in it those debts that are at better pay of interest. Everyone gets a second chance in America! Knightsbridge Debt Help Interest rates for personal loans: There are three types of Student Loans (U.

You'll start repayment in the April four years after the start of your course or the April after you leave your course - whichever comes first. ?Before you start an application, you need to know that most lenders require a minimum FICO credit score of 660, 40% maximum monthly debt-to-income, and $24, 000 in yearly gross income. � For entrepreneurs and independent freelancers, coworking. 67 so I could go to university, within 14 months of graduating, I owed �42, 648. ?Student Loans Company has a separate website * Cell Phones (Collections over $750) 50%

You have to satisfy the living expenses as well as several corollary expenses simultaneously. Knightsbridge Debt Help In most of the cases, the lenders agree to further lower down the interest rates Students who don't show enough financial need in line with the federal guidelines, but still require a loan to pay tuition fees, may qualify for an unsubsidized Stafford school student loan. It is embarrassing, and challenging and overall overwhelming when debt consumes you, but it is important to know that you have options. Twenty years is allotted for anyone with $20, 000 to $39, 999 loan balances. Student education loan is basically an unsecured loan that is available to students at a very low rate of interest as compared to other unsecured loan in the market.

Company representatives can be found to help you navigate all these programs. Consolidation Loans Low Rate I can check my credit standing through my bill on a monthly basis and I can see how it includes gone up, and the things that contain made it as great since it is (length of account opened, on time payments, lack of debt, etc . The major good thing about debt consolidation is to become debt free in an exceedingly short time period verses paying minimum payments to the credit-based card company which averages over 38 years to pay back. Log into your account or register as a new author. A guide to conditions and conditions?Since you're buying gas anyway consider by using a gas credit card for gas purchases. Just don't lower your payments unless it is absolutely necessary. How Refinancing Interest Rates Job

previous article next

Related Posts

How To Reduce College Loan Debt

Consolidate Private School Loans K-12

Student Debt Stats

Refinancing Student Loans In Default

What Is A Good Student Loan Consolidation Rate

Repaying Student Loan Threshold

Can You Consolidate Private And Federal Student Loans Gov

Student Loan Pay Off Principal

School Loan Consolidation Interest Rates Today

Student Loan Payment Structure