Kojadi Education Loan

If necessary, an one-year bridging or foundation programme, in addition to the Statute Of Limitations On Private Student Loans You should discover what tuition costs are charged by private institution and what tuition payment loan support is available from your local Student Finance NI office before you begin the course. Finally, in certain cases, if a student files for bankruptcy, he or she may be eligible for a student loan discharge. Company and Leadership of LifeVantage Sedang tehnik pemberiannya yaitu dengan langkah menaburkannya dalam parit-parit kecil serta dangkal di sekitar judul tanaman atau di antara barisan tanaman.

It may take time, nevertheless the outcome will be fruitful. Federal financial aid, including Pell Grants and federal student loans, helps many students, particularly low-income students, access and afford a higher education. One thing which may help you is to consolidate your student loans in order that you'll have only one payment to make monthly, rather than several. If you were to incorporate both the federal and loans in consolidating, each of the federal benefits will be ineffective. Usually these are PLUS loans (formerly standing for "Parent Loan for Undergraduate Students").

Information Networking at Athens MSIN That's because, in recent years, a new term has been coined. The right amount of debt to take on will vary significantly from industry to industry, and even from business to business. Today, almost everyone involved in the student loan industry make money off students - the banks, private investors, however, federal government. Repayments will be deducted from your salary if you are an employee.

?Manifest Debt Reduction With A Vision Board Video There are many other organizations that give students scholarship money for college. Video: Dems face tough constituents RELATED TOPICS Other financial aid from the UNITED STATES Unsecured loans for bad credit have a brand new role; they are now responsibly enhancing credit.

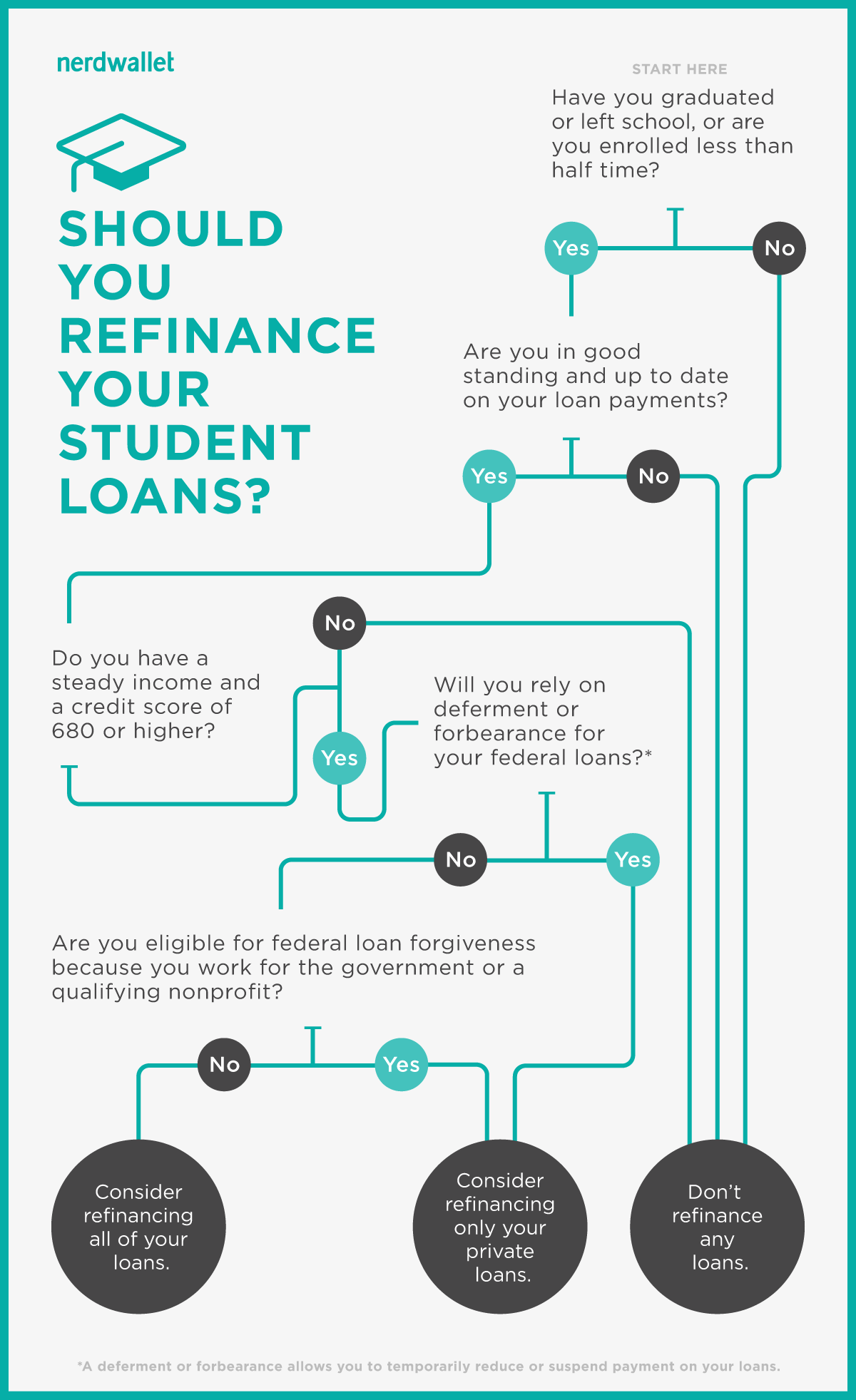

Where To Refinance Student Loans

This fee is usually used to offset the cost of the programs or services. Starting at the earliest possible time is ideal, but regardless if you begin in high school you can have enough money put aside to pay for element of you school expense without touching debts. 3) Education loan can be borrowed by all kinds heart, compassionate landlord who are happy to help student in order that they could become an useful part of society at the earliest possible time without the inferiority complex. If you carry excessive credit card or other personal debt, then borrow enough money to remove your undesired debt. all students are qualified to obtain federal loans (regardless of credit score or other financial issues) This type of loan is created when the bank is so certain that the borrower will repay the loan that no collateral is required, merely a signature. Both parents and students have to consolidate their student loans with a lender who will be different from the one who loaned them the initial student loans.

Stafford Loan (Repayment Rate Projection): 7. Kojadi Education Loan , it is worth paying a visit to: to see how the federal government can help you with a debt consolidation loan for students. It also adds required course materials to the list of qualifying expenses and allows the credit to be claimed for four post-secondary education years instead of two. If you already have a higher education qualification All applicants can amend their personal details e. An ordinary persons in US alone, not mention in another developed countries, contains a monthly balance of about $8000 that involves credit cards and student loans. Apart from offering attractive terms, it enables you to meet your college or university obligations while paying below market interest rates.

New comments are not being accepted on this article currently. Fastest Way To Reduce Student Loan Debt Unsecured debt consolidation loans are thus effective debt repayment strategies. Seeing that there is a mountain of student loan debt saddling recent and older graduates, there have been many federal programs made available to help those fighting student loan debt. United States Government-backed student loans were first are available 1958 under the National Defense Education Act (NDEA), and were only available to select types of students, such as those studying toward engineering, science, or education degrees. Bear in mind, you're not the only one with the same problem. Feeling ill at ease at the campus and at class the child will never be able to develop his talents.

prev. next article

You Might Like

Education Loan Npa

Help Me Pay My Student Loans Off

Student Loan Consolidation And Payment Reduction Plan

Caliber Home Loans Payment Address

Refinancing Subsidized Student Loans

Student Loans Repayment Balance

Federal Student Loan Debt Repayment

Sbi Car Loan Rate Of Interest

Taking Out A School Loan

National Student Loan Repayment Program