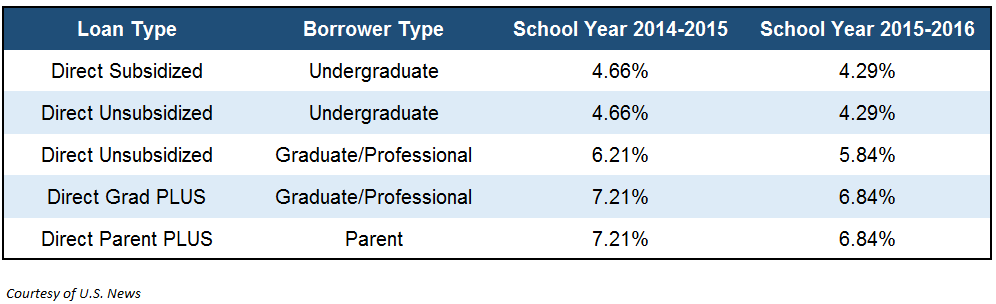

Most Student Loan Interest Rates

Sometimes federal student aid is not enough to meet the requirements of any student's financial needs. It is and will be a period of all is well within my soul. Nearly two-thirds of undergraduates are in debt.

Also the monthly loan repayment amount is less, therefore it becomes easy for the student to redeem. Student Loan Debt Stories The university participation level was relatively low. Gaining a deferment on your own student loan is an outstanding way to get a break. your payment on monthly basis is normally lowered If you need assistance in paying for the expense of your education, you can opt to apply on the Student loan. A virus can also damage human cells, which is one of the things that could make a person ill.

Sleep Debt And Depression In Female College Students

In this way, they only need to make just one monthly payment at a revised interest rate. The dependent undergraduate limit effective for loans disbursed on or after July 1, 2008 is as follows (combined subsidized and unsubsidized limits): $5, 500 per year for freshman undergraduate students, $6, 500 for sophomore undergraduates, and $7, 500 per year for junior and senior undergraduate students, as well as students enrolled in teacher qualification or preparatory coursework for graduate programs. There are many lenders that provide private student loans such as Bank of America or Wells Fargo. So , if you’ re not projected to save anything under the program, you don’ t pay anything! The higher the amount you save, the lower the percentage is to take advantage of the program. He or she may be called a debt relief specialist, settlement specialist or client services representative.

A good rule of thumb is to only have one card (or less) for every $2, 000 you make a month. As noted in last summer's post about this topic, about 2/3's of college students remain eligible for health insurance through their parents pre-existing policy. ?Student finance a structure of financial support that needs to be repaid, in contrast to other form of financial support such as scholarship and grants. Both students and their parents can avail of loan consolidation. Lower Interest: You lessen the amount of interest you are paying. Understand the distinctions between the types of programs used for debt consolidation solutions. In fact, an educated citizenry is an imperative for each and every country�s progress, and the student loan corporation is one method of reaching it year after year.

In case you are not in an excellent monetary circumstance, meet with a debt consolidation consultant to get out of debt as rapidly as achievable. The scale is from 1 to 10, where 10 is the best and 1 is the worst. To get the most out in the experience, make sure that the student also gets the rest and relaxation every individual needs by looking into schools offering large group accommodation with amenities to get a recreational activities or a sports and leisure centre. These days, there are plenty of credit card debt consolidation programs available for folks who are within a debt trap. With regards to student loans, many borrowers are turning to private student loans to close the gap between savings, student aid, scholarships, grants, and federal student loans.

"Actual" signifies that using the length of time in the month will be used to calculate interest. Most Student Loan Interest Rates The worksheet below should be beneficial to look at the big picture if it is in black and white prior to you. The thing that a lot of folks do not know is that it really is not at all hard to make a little additional money in the event you genuinely put some effort with it. These interactive charts show how scholar lending receive and offense cost disagree among Time family and over repetition. If you have private lenders for the student loan, they will sometimes work with your lenders in order to lower the rates that you pay. For instance , the price for a 42 ounces Without easy access to information, some students lacked an understanding of the loan provisions, and delayed paying for their federal student loans.

For many borrowers of private loans, a cosigner is necessary since the primary borrower is a student with limited credit history. Consolidated Federal Student Loans Gov Think carefully about whether this is effectively for you. When you obtain a loan, you might get a subsidized or an unsubsidized loan. From these finances, instant loan, personal loan, bad credit personal loan, consolidation loan, business loan to unsecured loan with poor credit. Annual pay raise - again this is a proposal, but you may have an concept of potential earnings for your chosen career path, for example an attorney earns more in the long-term than the usual teacher. It truly is no coincidence that a number of the hardest hit by previous versions of the loan system were from the poorer families the system was supposed to 'enable'.

prev. >>>

Related

Osap Student Loan Interest Rate

Loan Payment Administration Xenia

Ism Education Loans

Consolidate Student Loans Td Bank

Government Jobs To Reduce Student Loans

Private Student Loan With Bad Credit And No Cosigner

Where To Consolidate Private Student Loans

Sofi Student Loan Consolidation Reviews

Private Student Loans Lowest Rates

Loan Consolidation For Student Loans Uk