Private Student Loan Consolidations

Overview of Student Loan Forgiveness Programs Consolidation usually means working with a debt consolidation company or talking to various creditors to make special arrangements. But not everyone has the ability to do so. A defaulted education loan can stick to one's credit report indefinitely, provided that the loan remains in default, and then for up to seven years following repayment, once the defaulted debt has been paid off. The solution should be a fairly easy one: Quit spending! The fact is, though, that it isn't as easy as this might sound. Private Student Loan Consolidations Studies take a back seat when debts start to hold a prominent place in students' finances.

It is undeniable that every college or university student will have to pay for their higher education but if students were educate themselves on debt, and then many would not have to over pay for your education. Private Loan Consolidation Options Without having debt problems on hand, after debt consolidation, you could possibly be tempted to spend more and get further into debt. Students can also be eligible for government loans which can be interest free while at school on top of this line of credit, as private loans do not count against government loans/grants. It can be said that these days, students pass with a debt to be paid by them. Not a full-time student? You can still make application for a private student loan! In an article published in December of 2018 on the financial portal 'Business Insider', some real life stories were illustrated about people who took out loans for their education.

Student Debt A Calculator Focused On College Majors

Let's say you have a $30, 000 loan having a 4. College student loans are simple and easy for the scholars to follow. Loan terms, conditions and policies vary by lender and applicant qualifications. Recently, tuition has been rising because of the cuts of government funding in education. We discovered that many people who were also searching for information related to Personal Student Loans also searched online for related information such as Federal Student Loan Balances, Federal Student Loan Servicing Center, and even Private Student Loans Without Credit.

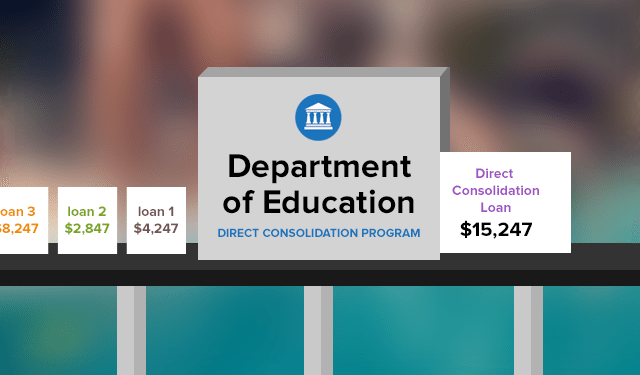

The student awarded a Stafford Loan can choose the bank that will be lending the money for that loan. Do you have student loans or other debts? Life insurance will help your loved ones pay off these debts if something happens to you. if you really have a true intention towards establishing an own debt collection business, embarking on a self analysis should be a vital step. Federal student education loans and private student loans cannot be consolidated into one big loan. Many students have found that credit cards create a lifetime of trouble down the road; therefore , they simply are not suitable for charging food, gas, textbooks, or any other bills. Instead of making credit card payments on a number of different credit card loans, students now only have to make a single Student Debt Consolidation payment.

Student Loan Consolidation Options

Negotiating with creditors to ensure that reduced rates of interest and better monthly options could be offered to an individual with more debt than he or she can handle. Private Student Loan Consolidations Students are able to obtain a loan of $5, 000 for each six months, but can only get a total of two loans throughout their lifetime. If you are a student, apply for financial grants and scholarships because these are non-interest bearing financial instruments. 8 percent Medicare payroll tax on investment income for individuals making more than $200, 000 a year and couples making more than $250, 000 a year. Along with an in-depth research and writing, additionally, you will have to get your dissertation bound.

The bill, which is being reconciled with the Senate's version, would also require private lenders to obtain from a borrower's college certification of his or her enrollment status and cost of attendance before issuing any loan funds. Private Student Loans With Cosigner Release In most cases, the province of residence is the province one lived in before becoming a post-secondary student. The consumer can then be left with a principle loan and interest payments on a single bill. This loan is equivalent to a Stafford loan but currently has lower fixed rate (5%). These five 50p coin designs are worth up to �3, 000. The company paid colleges shed out of the federal program and make Sallie Mae the campus student loan provider.

Previous Post Next Post

Popular Articles

Qualifying Loan Payments

How Long Can You Refinance Student Loans For

Car Loan Interest Rate Rbc

Who Can Consolidate Federal Student Loans

Getting Out Of Default Student Loan

Consolidate Multiple Private Student Loans

Canada Student Loans Program Interest Relief

Student Loan Refinancing

Book Loans For College

Pay Off Student Loan New Zealand