Scholarslip A Documentary About The Student Debt Crisis

A subsidized loan is by far the best sort of loan, but an unsubsidized federal education loan is far better than a private student loan. You can transfer your existing card balances to a single, low interest rate card and thereby reduce regular bills. As you leave the university life, you will be facing a variety of loans with different rates of interest. Then immediately say goodbye the phone. Continue reading to learn what you need to know about debt consolidation can help you. Scholarslip A Documentary About The Student Debt Crisis Today my husband and I had our fifth fight.

For more information and advice, please contact the Admission Office admissions@ Student Loans Refinance Internal Pressure to Attend the "Best" College The average obligation is around $19, 000 but higher for graduate students ($27, 000 to $100, 000+. Both the FFEL and Direct Loan Programs offer consolidation loans. You can find out about the complete payment processes, like the calculation of payments.

Fafsa Student Loans Payment

A new method of funding from private investors is more tempting compared to previous financing method directly from taxpayers. "Haunted by Student Debt Past Age 50. The short term installment loans for students with bad credit history give a way to fund their higher education. So how and when do you begin to repay your student loan? This really is made easy for you as you will never be required to pay anything back while you are still in education, it will only be paid back, if you have got what you went there for by graduating or simply in case you leave the university or university to take up work, however, you will only have to pay it back in case your earnings exceed �15, 000. Find Compatible Scholarships and Grants

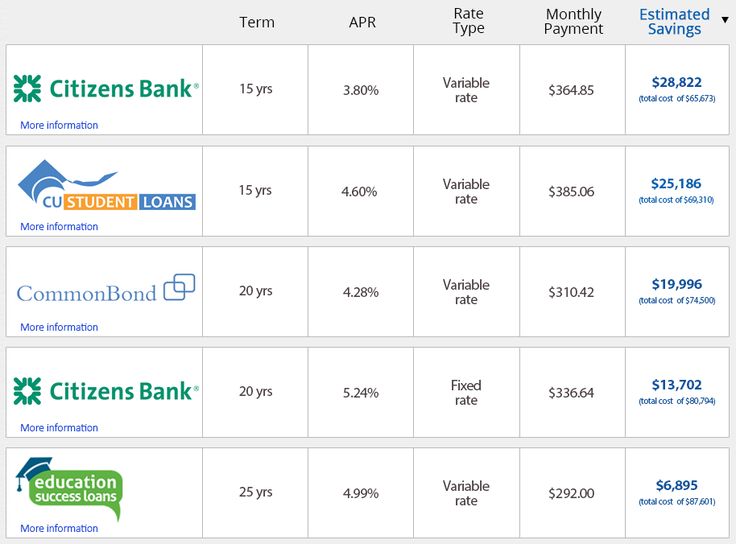

The basic concept is that you simply are getting a new loan to repay your entire outstanding student loans; which mean rather than having 3 student loans with 3 repayment amount and due date, following the loan consolidation, you only have one main loan with one repayment amount and one deadline. The student must be you, your spouse, or a person who was obviously a dependent of yours during the time they were in school. As a result of loan consolidation one will need to actually dole out lesser repayment amounts. Do not buy anything that you don't need And so, in order to avail the cheapest rates offered in the market for people loans, you will have to compare loan quotes. Department of Education contended that Brewer didn't qualify because technically, the school hadn't shut down - it still had campuses in the South and overseas. Student loan consolidation process with lower rate of interest would be a great relief for the otherwise financially constrained family.

Refinancing Private Student Loans Fixed Rate

those with a high school diploma was $16, 638, though this varies considerably by field of study. If you really want to finish your college or university education, there will always be a means. But for those taking out loans since 2018, the rate is based on the RPI (retail prices index) measure of inflation in March, which was published on Tuesday. After you pay off your student loans, you can start buying houses and investing in the stock exchange like a real adult! What happens on death or incapacity It is so extensive and widespread that if you look closely you would find that it includes the needs of everybody who wants to access loans. The good news is that the spreadsheet you created can calculate the total amount you are due in seconds!

Are there discretionary expenses you can lower or eliminate? It might not be fun, but it can be worth the cost. Scholarslip A Documentary About The Student Debt Crisis Whenever you feel urgency of cash you go to your family relatives, take help of your friends, your neighbors but sometimes when problems creates nobody comes for your aid. If you do not satisfy the loan repayments as required by your loan servicer, you can go into default. Make sure to include things like your monthly gasoline budget, groceries, entertainment expenses, and any other odds and ends. Long Term Offers: If you are going to need some time to pay the debts off then make sure the consolidation offer allows you to do this. It is important to understand what makes up a secure website and how to figure out if it is secure.

If you're careful, you may not be bogged down for the remainder of your life paying back your loans. How Many Times Can Student Loans Be Consolidated Many persons earning over? 21, 000 will never pay all of it back within the 30 years They are the present financial status and the year of your academic course. The rate interesting is lower than your loan consolidations and so you pay lower monthly payments. After a 30-year career at the forefront of the education loan industry, Lord retired in 2018 and now shuttles between houses in Naples, Florida, and Annapolis, Maryland. Tolman studied three categories of rats. It is worth noting that net tuition price can often be seen as the most useful measure for estimating the expense of attending an institution because it captures the fact that many students does not have to pay the full cost of attendance, as they receive grant the help of the state or federal government and also the institution itself.

last next

More

United Guaranty Default Student Loan

Phd Students In Debt

Can U Get A Student Loan With Bad Credit

Rehabilitate Or Consolidate Student Loans

Student Loan Repayments Hmrc Tax Return

Student Loan Consolidation Lenders Handbook

Car Loan Rate Qld

Student Financial Aid Quotes

Student Loan Payments Taxes

Loan Rate To Credit Score