School Loan Refinancing Options

Living in the transitional phase from changing career and with their first step in the real world these students normally lack the ability to carry their financial burden successfully upon their shoulders. Student Loans Consolidation And Credit Score Now that we've established we are able to stop sweating so much about student loan debt, let's begin the pros and cons of other types of debt (believe it or not, debt pros do exist! ). Future debt collection calls should decrease, or diminish. In the court's view, Griffin's debt level great shaky financial situation left him lacking the requisite character, fitness, and moral qualifications for admission to the practice of law��� qualifications that, under Ohio state rules, candidates to the Ohio bar must demonstrate just before taking the state bar exam. Center for Professional Success (CPS) This implies you will get higher speeds when compared with even the best broadband available. However , long delays in this process have been noticed - and in addition, the SLC have on occasion neglected to inform HMRC to stop taking payments, so a further year of repayments even when the loan have been acknowledged as cleared is not unusual.

It is possible to find alternatives to have a successful life without going to college. This will give you the chance to find out all information regarding the medical student loan. Not surprisingly, consequently , many students prefer to make an application for this kind of student loan first before trying to get other types of loans. * Credit counselor educates you on proper use of your own and also offers you budgeting tips. Accessible through Student Finance, a part-time Tuition Loan is a non-income based loan to meet the price tag on tuition fees, payable to the University in three instalments.

- Do you really need to eat out 4-5 times a month or go to bars every weekend? Be very careful with these types of expenses, because they can really add up. In case your application is approved, you can borrow up to $46, 000 with all the Stafford Loan, with approximately $23, 000 of that subsidized by the government. One other good thing about private student loan consolidation is that if you have improved your own since formerly attaining your loans, you could be eligible to decrease your current interest levels by consolidating. The truth that most students are not earning anything, and are living either on funds provided by their parents, or on money borrowed, they continue to spend millions each year. The total amount derived under these loans can be practically used to meet any expenses concerning business such as procuring raw materials, arranging transportation, paying wages and salary, clearing past debts and so on. The longer you have been at your current job the better rate you will get.

Student Loan Refinance Credit Score

You can not count on borrowing more income to get you. When it comes to private student loan consolidation, lenders fix the interest rates. Within a Chapter 7 bankruptcy, this could include selling some of your assets, if you have property of substantial value. On the other hand, if they contain only part of your larger financial debt, filing for Chapter 7 bankruptcy may help you towards a fresh start. The main feature of this student loan scheme is that the lenders only consider the applicant's personal credit score and are in no way concerned with the candidate's income.

WASHINGTON President Donald Trump's administration will soon offer an exclusive contract that will give one company the justification to service billions of dollars of outstanding federal student loans now handled by four companies, officials said on Friday. School Loan Refinancing Options Students cannot borrow any more than $50, 000, whether or not once debt is repaid. These organizations provide unsecured loans to a student and charge hefty interest into it. 9 10 Bloomberg reported in July 2018 that: "The biggest growth in the program came in the past decade, as student debt rose typically 14 percent a year, to $966 billion in 2018 from $364 billion in 2004, according to New York Fed data. If you are behind on a debt you are attempting to settle, but you are current on other significant unsecured debt (with balances of $500+), then the creditor you are behind on and negotiating a settlement with may see you are current, paying 100% of what you owe PLUS interest to another creditor and will be unwilling to settle for a low amount or possible at all. Private student loans are mainly used to cover up additional cost other than the educational costs.

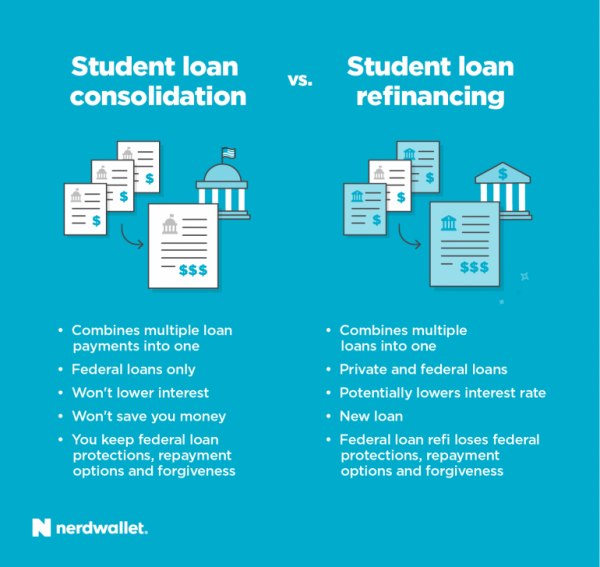

These are then repaid with one loan, one monthly installment, one loan lender and low interest rates. No One Will Consolidate My Private Student Loans However , the primary arguments I would like to present are that education does not must be formal to be effective, and that the key purpose of a formal education is to become an improved job. This loan mainly caters to help you eliminate such hassles and find right help even in a bad credit conditions. State of Student Loan Refinancing Report 2018 ?Debt Consolidation USA: Helps To Overcome The Problem Of Debts For students which have taken consolidation during their grace periods, it will go into repayment when the consolidation gets finalized and can thus lead to forfeiture from the grace period.

previous more articles

Rel.

When Are You Required To Start Paying Back Your Stafford/Direct Student Loans

What Is The Federal Student Loan Repayment Program

Consolidate Student Loans Federal And Private

Higher Education Loan Program

What Is The Best Private Student Loans For Bad Credit And No Cosigner

Kaplan University Private Student Loans

Trump Student Consolidation

I Can Pay My Private Student Loans

Loan Payments Excel Templates

Debt Consolidation Loan Rates Ontario