Student Loan Default Program

Unless you have go through the fine print before you register the offers, you could be hit by hidden charges or unexpected interest rate increases following the promotion period. Student Loan Consolidation Center Letter Of that 20 million, near 12 million�- or 60%�- borrow annually to help cover costs. The process is a lot much easier to complete if you take you a chance to do so with your parents with the advice of your accountant. When these plans fall through, the former students can find themselves in serious trouble and they should seek student loan debt consolidation advice. A basic understanding of the underlying influences precipitating market conditions help investors in their decision making process of when is the appropriate time to buy, sell, refinance properties consistent with formulated investment objectives. Make sure spot the warning signs with these tips. Do check your credit limit, balance, interest rates, and costs ahead of withdrawing an advance from a credit card.

The federal loans normally have a rate of 8% and if you merge For more about student loans and finance, go to 8 percent) than Stafford loans, which have a rate of 4. They can either be secured in the name of the parents or the students, however they need to be paid when the repayment period begins. Debt consolidation can impact on your credit. The Distribution of College Graduate Debt, 1990-2008: A Decomposition Approach / Brad Hershbein and Kevin M.

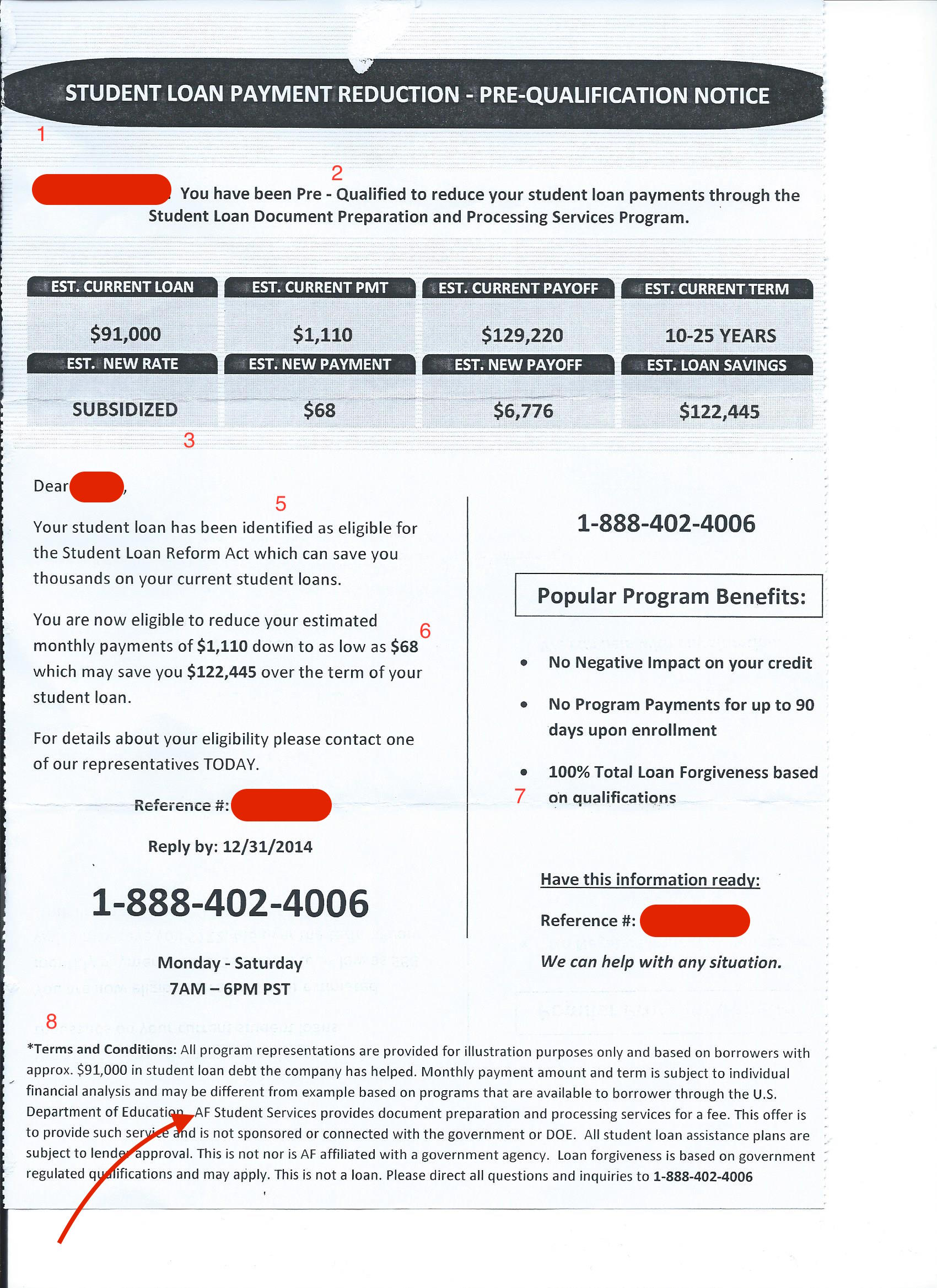

At LendEDU, we give SoFi our stamp of approval for refinancing your student loans. These thresholds are updated each year to take account of price changes. More than likely you may have already received mail or email regarding your pre-approval for a student loan. Perhaps some of this could be blamed on the typical slowdown of the complete world economy, but a much more likely reason is that banks are not lending. A repayment is taken in any weekly or monthly period where the gross income exceeds the present applicable threshold (�403 each week, �1, 750 per month or �21, 000 equivalent). How would you go about choosing an unsecured consolidation program? The first step to take is usually to meet with a professional to give you advice.

Getting a job can help pay the bills. This I can speak about from first-hand experience. With a typical balance of $28, 400, student debt is a huge part of the average college or university graduate's life. Why Consumer Debt Counselors Was Needed Easier said than done, nonetheless it is important to balance your job and academic life.

Student Loan Consolidation Us

In this article, we will discuss different kinds of college loans you can apply for to help you choose the type which suits your requirements. Even bad credit holders can access instant student education loans. However , it still services outstanding student loans. These fees raise the real cost to the borrower and reduce the amount of money available for educational purposes. It is calculated for 900 and anything above 500 is considered good CIBIL Score. Earning should not be less than �1000 per month. Top ten Helpful Hints in Getting Student Loans

It would then be put after you to aggressively over pay the monthly amount due in an effort to reach a zero balance sooner. Student Loan Default Program This means that students can concentrate on their studies. Inflation will be 3% each year (Bank of England statistics show inflation for 2000-2018 to be 2 . The president emphasized trainees loan reforms at a signing ceremony at Northern Virginia Community College in Alexandria, Virginia. Such loans are only available to students with credit worthiness or those with cosigners ready to back them on their loan. If I be wrong, may God Himself chastise me harshly in leading anyone astray.

They will arrange to gather repayments directly from you. How To Refinance Student Loan Debt The processes of being sued for debt are incredibly similar in britain and the US. Also, a college or university degree could give you higher bargaining power when it comes to negotiating your wage package. You need to tell them about your current financial situation and how much debt you have. Secured loans have several advantages like lower rate of interest and longer period of repayment. It can help you pay your way through college comfortably but not excessively. Typically their advise is to send a cease and desist letter, this can stir up a hornets nest.

previous article Next Post

Consolidated School Loans Early

National Student Loan Debt Help

Student Loan Payback Options

Refinance My Federal Student Loans

Consolidating School Loans Private Loans

Can I Reduce My Student Loan Payments

Student Loan Interest Rates Lowered

Student Loans For Harrison College

Student Loan Consolidation Affect On Credit

Emc School Loan