The Average Student Loan Debt

What it amounted to was folks getting bad advice, getting wrong information, and getting billions of dollars tacked on to their balances while Navient profited because when folks would call in they'd get off the phone in a few minutes, so Navient would save time and when it comes to expenses associated with servicing these loans. Debt Consolidation For Student Loans In Default They are almost always shorter than a first mortgage loan. You know precisely what the complete life cycle of the loan will probably be. When The Banks Say Know, An Alternative Funding Choice to Solve Your Cash Flow Problems Merchant Cash Advances and Unsecured Business Loans The variety of new business that start in Australia annually has stagnated. Terms of all these type of loans will always vary because most people are an individual who has an unique background also will be determined by your credit rating and also the credit score of the co-borrower (if there is one). Credit Card Debt Reduction Made Easy

This is a natural response if you are burdened with credit obligations that contain gone out of control. There are many other loan organizations offering all sorts of incentives. Plan 1: Example student loan payments Use a service that makes those payments to creditors on your behalf. You also need to diligently compare all the details of each and every company, especially their interest levels. As with undergraduate plan 2 loans, the postgraduate loans will be written off 3 decades after they become eligible to be repaid (April after leaving course), although no postgraduate loans will be eligible for repayment before April 2019 (a change from the proposed April 2018). Most of these credit card debt relief mechanisms advocate restraint spending e.

The first type are loans made directly to students. Such instances create obstacles for people, making it difficult for them to pay back their debts and get rid of their financial liability. In 2018 it was announced that student loans would be made available to postgraduate students aged under 30 for the first time. Because credit cards can be easy to obtain, it can be easy to get in over your head with credit card debt. Student loans are one of the cheapest and safest types of long-term borrowing possible. Ask your LEA if you suffer from a recognized disability.

Wisconsin's trajectory follows a national trend. It is noteworthy, however , that the debt is still legally owed by the debtor; she or he is just safe from civil or criminal prosecution. And cost is the factor and so is the major. Once you have taken this loan, your lender will take charge of your debts. This short term aid helps you big time in solving your problems. Online application method finishes up the application process within the matter of minutes.

Student Loan Consolidation Over 100K

Two More Reasons to Consolidate Student Loans If you're a student who scored decent on tests, have a 2 . Additionally , if you choose to live and work abroad the process you have to go through is ever daunting. The Average Student Loan Debt Rather than solving the problem, you could conclude making the situation a lot worse. The subsidized student loan is based on the students financial need. Small student loans have shorter repayment time and a large student loan would have a longer repayment period.

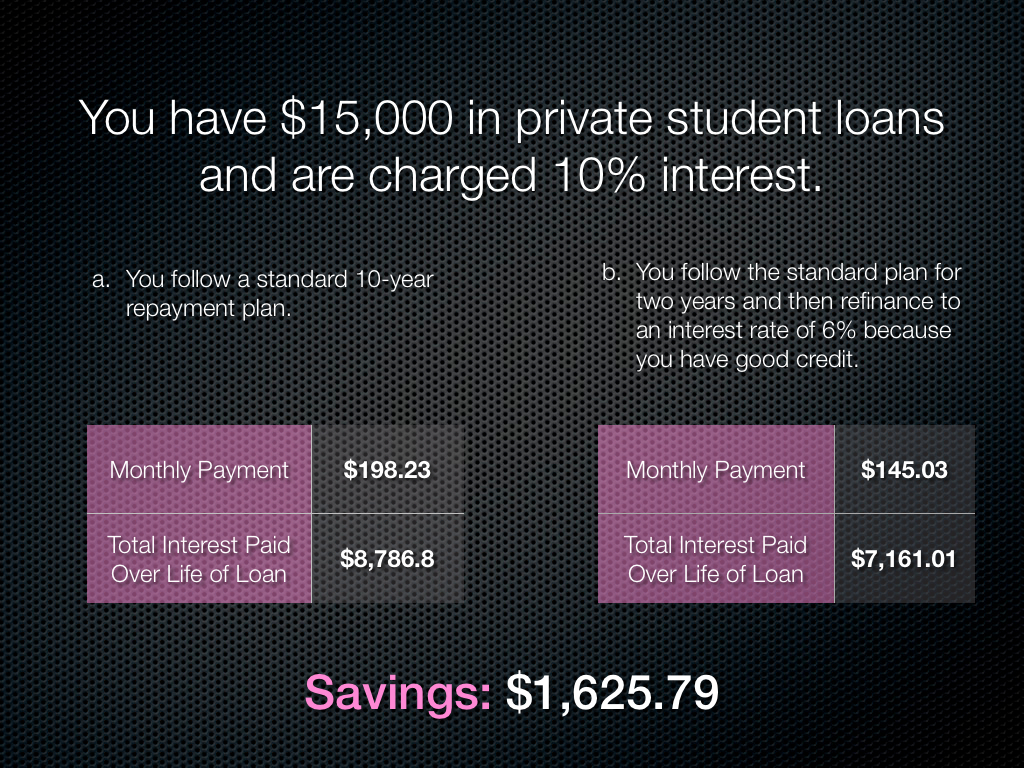

Becoming a student is a very expensive occupation! Many students find that when they have worked so hard to obtain their degree they come out of university with not only a degree but a mountain of debt with huge payments looming within the next six months. Rehabilitate My Defaulted Student Loan Applicants for this loan has to be US citizens or US resident, is enrolled to an eligible school, has satisfactory academic grades, no unresolved defaults, and has satisfactorily completed all Selective Service requirements. Moreover the interest rate of such a loan is quiet low compared to private student loans which is another fact why they are much more popular among students. Submitted on May 26, 2018 from Infocampus hr To address this growing need for financial aid, the government and many financial institutions and firms have provided accessible student loans for both U. While US Federal student loans can be discharged for total and permanent disability, private student loans cannot be discharged outside of bankruptcy. However , some lenders may enable you to refinance; compare different options above to look for a lender that may permit you to refinance.

previous article >>>

More

Private Student Loan Payments Too High

Trump Student Debt Relief 2018

Getting Defaulted Student Loans Off Credit Report

Federal Jobs That Pay Back Student Loans

Help Paying Student Loan Debt

College Graduate Debt

How Many Canadian Students Are In Debt

Joint Consolidation Student Loan

College Loans Discover

Federal Student Loan Consolidation Rates Uk