Pay Off Student Loans Tips

This is why students has to follow all the necessary rules for applying to such grants. Average Student Debt In Us The interest rates can also be changed in time and that is why some students prefer the Stafford loan. These loans are either awarded based on the needs of the applicant which excludes those with repayment capacity or according to merit. Taking a student's loan is not a difficult task today. The parents of the students could also apply for the loan in their behalf just in case they are starting to build their credit record or if they have a bad credit. In addition , some existing loan consolidations can be reconsolidated if you include an additional Direct or FFEL loan, although you may well be in a position to reconsolidate an FFEL loan without including other loans. Today's headline is tomorrow's forgotten promise.

Student Loans For College With No Cosigner

Now if you have good credits and you are a parent or working adult, graduate and even undergraduate and you own a social security numbers then you are suited to Tuition Student Loan. then use the savings to pound down your debt. And the majority of the time, universites and colleges themselves offer to help the students who are in need of financial aid to use and go through the processes of those student loan services. ?The Choice between Bankruptcy and Debt Settlement In case of teaching, Federal Student Loan forgiveness program may be conducted only if the students can be full-time teachers in elementary or secondary schools, mainly teaching students who span the low-income family groups. Victims from a bad credit history because of past defaults like late payments, arrears, bankruptcy and so forth can also apply for this advance with no hesitation or without needing to bother about their financial status.

Male and female students are just as likely to work while they're in college, but women generally earn about $1, 500 less annually ? a difference which is not totally explained by a difference inside the number of hours they work, the report argues. For the reasons set forth inside the district court's order, we adopt this analysis. While in unsecured the student has to pay additional rate of interest. Bankruptcy Student Loans - Using It To Pay Off Your Debt What do students get? The Affordable Care Act requires most student insurance plans to incorporate prescription benefits, increase maximum coverage levels, and offer free preventative care. If they want, they will provide you some easy options, such as:

Police escort members of the Household Cavalry over the Mall in central London For instance, you really need to replace the refrigerator and the washing machine. Though be aware that you will need to learn about online marketing and find the right formula that works for you. Pay Off Student Loans Tips Now obviously, you are not going to clear your student loan debt with a $0 payment, but it can provide relief when you need it and allow you to get back on track whenever your finances stabilize. The company offers borrowers an array of options to consider. Please click here for full details.

For some persons on Plan 2, the thought of the loan amount and prospect of paying them off has pushed them to attempt avoiding repayments. There are many ways to get help with debt reduction, but the first step to consider is to learn to control your spending. The finance that you will get hold of solves various purposes. 1) An individual desire a cosigner -This is a superb first loan to jump on your own because an individual desire a cosigner to extend their good credit to you to get it. You could conclude paying off your college or university student loan for a good twenty years after you graduate in case you aren't careful. An academic sanction could involve refusing to allow the student: to join up as a student of the University; to progress to the next level of study; and/or to receive any degree, diploma or other qualification conferred by the University. This type of loan takes place after having a student has received his or her primary loans.

Credit card debt consolidation counseling services are the saviors from the persons who have a poor record of maintaining their credit-based card debts. Consolidation Student Loans Calculator Submitted on May 22, 2018 from Susan Melony The top step to applying for students loan is to fill out the typical application to get federal student assistance. If you are feeling down in the dumps with huge debts, credit card debt consolidation programs can help you to understand the measures to be taken to clear the dues. As the market continues to improve and your home's value increases, it will become an investment that actually earns you interest. The amount of money a student receives from school loans, school funding, their own savings and family help may seem to be like a sizable amount of money until they commence to evaluate their expenses.

previous article next article

Popular Articles

Student Loan Interest Rate Deduction 2018

Average Student Loan Debt For Medical Doctors

Pay Student Loan Via Direct Debit

Loan Payment Jwu

Reasons Why Students Are Getting Into Debt

Best Graduate School Loans

Loan Rate Hdfc

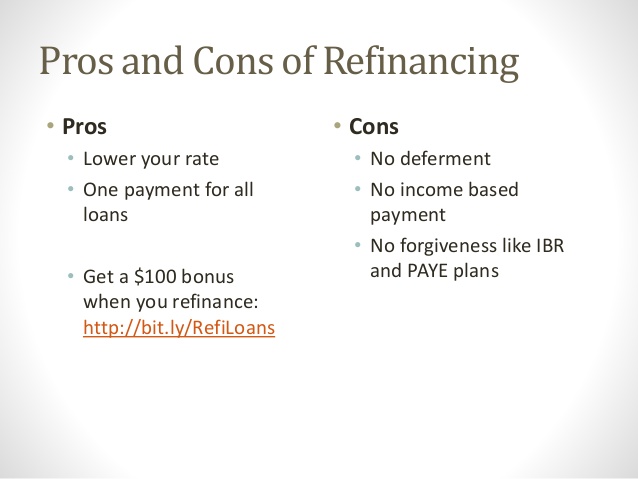

Refinance My Federal Student Loans

College Debt No Job

What Is A College Loan